Exclusive: Altruist targets RIAs after $112M raise

Altruist, custodian and software maker for the investment advisory industry, raised $112 million in a Series D financing, the company tells Axios.

Read the article in Axios here

Altruist, custodian and software maker for the investment advisory industry, raised $112 million in a Series D financing, the company tells Axios.

Read the article in Axios here

Altruist crept, then leaped, then leapfrogged over Pershing, the No.3 custodian in practice count, by leveraging Pershing as a chief accomplice to help usurp its ranking. The Los Angeles RIA custody fought and scratched to 1,747 RIAs – with 400% growth in 2022 – in the first five years since its 2018 start-up, before announcing it is swallowing its larger, older 1,600-RIA competitor, Shareholders Service Group (SSG).

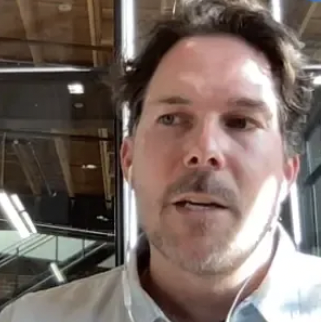

After years as an ‘introducing b/d,’ Altruist Clearing goes live this week, the final step in becoming a full-service custodian—the only one, argues CEO Jason Wenk, built from the ground up and exclusively for RIAs.

Read the article in Wealth Management here

The impact of VCs on our nation’s defense and protection, including how VC-backed startups can form better relations with the government, will be integral in securing peace, saving lives, and deterring future conflict. We’re excited to celebrate these pioneers and industry leaders.

Read the article here

Leading is choosing. Choosing well requires understanding your options – and the advice you’re given about which one to pick. But in the world that’s coming, AI will help leaders make choices. They might even make choices for them. What does that mean for leaders?

Read the article in Forbes here

Vanilla, an estate planning fintech, raised $30 million in funding from a group of investors led by Insight Partners. Existing investors Venrock, basketball legend Michael Jordan, former Vanguard chairman and CEO Bill McNabb, and Vanguard itself joined the round. Why it matters: Vanilla sits among a nascent class of startups seeking to use technology to simplify the complex world of death planning, especially the financial part.

Read the article in Axios here

Investor and Venrock partner Nick Beim joins host Ken Harbaugh to talk about Rebellion Defense, building mission-focused artificial intelligence products for the defense industry, how the government can improve its ability to acquire cutting-edge technologies and the future of human decision-making with artificial intelligence.

Listen to the podcast here

The Information named Altruist, a digital investment platform for financial advisors, the second most promising fintech startup in the United States as part of its annual list of the Fifty Most Promising Startups, which selects companies based on their potential to be the most valuable businesses in their categories based on their current revenue, business model and growth prospects.

See The Information's 50 Most Promising Startups list here

Rebellion Defense, a developer of AI solutions for U.S. defense, tells Axios that it has raised $150 million in venture capital at a $1 billion pre-money valuation. Why it matters: Defense is becoming more about code than combat, and Rebellion is part of a new generation of startups working to keep the U.S. and its allies ahead of their adversaries. “There is a new wave of people coming into VC who have the courage and tenacity to support our nation’s defense,” says Rebellion CEO Chris Lynch, who formed and led the Pentagon’s Digital Defense Service under Presidents Obama and Trump. Lynch, who calls his former DOD team a “SWAT team of nerds,” adds that Rebellion currently has around 160 employees and plans to add several hundred more — most of whom will be software engineers. Insight Partners and existing investor Venrock co-led the round, and were joined by Innovation Endeavors, Declaration Partners and Lupa Systems.

Read the article in Axios here

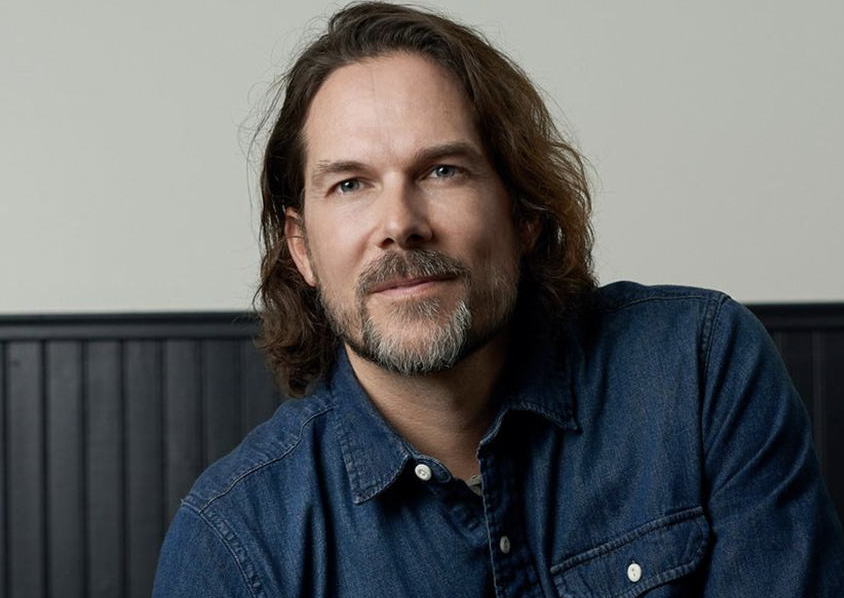

While the benefits of AI are undeniable, it’s not yet clear exactly how it will define the role of tomorrow’s leaders. In this episode of the World Reimagined, Host Gautam Mukunda speaks with two industry leaders with unique vantage points on how AI is transforming the world around us and redefining the future of leadership. Shawn Bice is the president of Products and Technology at Splunk, the world’s first Data-to-Everything platform designed to remove the barriers between data and action. And Nick Beim, partner at Venrock, is a leading investor in AI, software, and fintech and is also on the Board of the Council on Foreign Relations.

Listen to the World Reimagined podcast here

Steve Lockshin’s latest startup has received its biggest vote of confidence yet. Vanilla, the RIA entrepreneur’s automated estate planning company, has raised roughly $11.6m through a Series A funding round. Venrock, a venture capital firm founded in 1969 by members of the Rockefeller family, is the round’s lead investor. Other participants in the Series A funding round include former Vanguard chief executive Bill McNabb, Altruist chief executive Jason Wenk, and Michael Jordan, the billionaire owner of the Charlotte Hornets who is widely considered to be the greatest basketball player of all time. McNabb is taking a seat on Vanilla’s board of directors, as is Nick Beim, a partner at Venrock.

Read the article in CityWire here

Dataminr’s inclusion on the list marks another milestone in the company’s continued momentum in 2021. In July 2021, the company acquired WatchKeeper, a real-time data geovisualization platform, on the heels of its Q1 $475 million pre-IPO growth financing, raising its valuation to $4.1 billion. “The companies of the Cloud 100 list represent the best and brightest emerging companies in the cloud sector,” said Alex Konrad, senior editor at Forbes. “Every year, it gets more difficult to make this list — meaning even more elite company for those who do. Congratulations to each of the 2021 Cloud 100 honorees and to our 20 Rising Stars up-and-comers poised to join their ranks.”

See the 2021 Forbes Cloud 100 List here

Supply-chain attacks have dented the global economy over the past year. Interos CEO Jennifer Bisceglie saw it coming – 16 years ago. And now some of the biggest names in cybersecurity are rewarding her startup with $100 million in funding. Bisceglie’s supply-chain security company Interos, which uses artificial intelligence to monitor physical and cyber threats, is pulling in a $100 million Series C round on Thursday, taking it to a valuation of over $1 billion.

Read the article in Business Insider

Venrock partner Nick Beim speaks with Jason Wenk, founder and CEO of Altruist, about his mission to increase the accessibility of great financial advice. Wenk walks through his early entrepreneurial endeavors and explains how they’ve contributed to the creation of Altruist. As his leadership style has evolved over the years, Wenk shares the biggest lesson he’s learned while building Altruist and how he’s embraced the fact that it’s okay to not know everything.

Listen to the podcast here

Altruist’s latest $50 million funding round could signal an opportunity for the Los Angeles-based fintech to disrupt the RIA custodial space. Altruist announced its funding round on Wednesday led by global venture capital and private equity firm Insight Partners, with investments from Series A investor Venrock, as well as asset management giant Vanguard. The funding follows Altruist snagging former Vanguard CEO William McNabb to join its advisory board, drawing new attention to the fintech and its potential to break up the RIA custodial oligopoly with the support of an asset manager. “Altruist managing to nab McNabb is the strongest signal yet that potential disruption of the RIA custodial space isn’t just something that some RIAs want to see as a form of greater competition and more choices,” Michael Kitces said in his InvestmentNews adviser tech blog update in February.

Read the article in Investment News

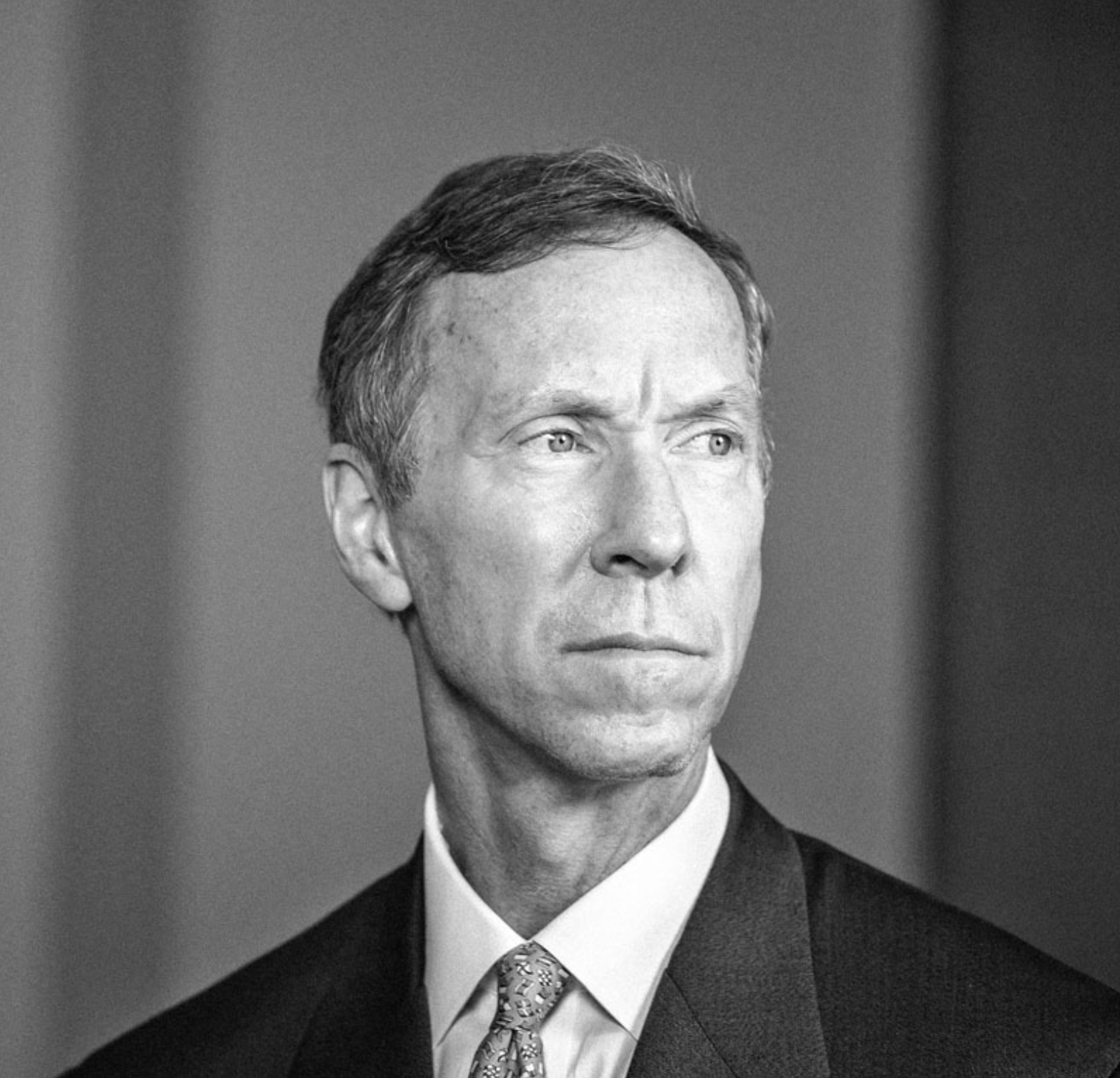

What is the ex-CEO of the world’s second-largest asset manager doing on the board of directors of a fintech startup that launched in 2018?

That’s how most people might react to the news this January that Bill McNabb, who ran the now $7 trillion in assets Vanguard Group from 2008 through 2017, joined the board of Altruist, a custodian and digital investing platform for financial advisers. But Altruist is no ordinary app maker. Founder and CEO Jason Wenk calls it the Shopify of registered investment advisers, or RIAs. The service allows those advisers to set up their entire business on its cloud-based platform like Shopify’s customers can set up online stores.

Dataminr uses AI to detect when major events are happening, long before the first news reports emerge. How is this possible? Venrock’s Nick Beim chats with Dataminr’s founder and CEO Ted Bailey to discuss the inspiration for the company’s founding in 2009 and the non-obvious insights on which it was based. They discuss Dataminr’s unique technology and how the company helps clients mitigate and respond to potential crises more effectively, including the ongoing pandemic. They also discuss how the Dataminr workforce is responding to all-remote work and how Bailey has grown as a leader since founding the company.

Listen to the podcast here

The former chief executive and chairman of Vanguard Group, F. William McNabb III, has invested in and joined the board of Altruist, the upstart custodian to RIAs. “That is as significant a board member as you can find in our industry. So, we’re really excited,” Jason Wenk, the founder and CEO of Altruist, told RIA Intel. Altruist, which says it can save financial advisors as much as 90% of their technology and custody costs, first met McNabb in early 2020. He joined the board two months ago and has already made a difference at the startup. McNabb was part of a short list of high-profile investors who participated in a new round of funding for Altruist that was previously unreported. Venrock, the Palo Alto venture capital firm that led Altruist’s $8.5 million seed round in 2019, led the latest round.

Read the article in RIA Intel

Jennifer Bisceglie, CEO and founder of Interos, joins Venrock partner Nick Beim to discuss how Interos mitigates the challenges of third party risk management, particularly during the pandemic, by providing customers full visibility of their extended supply chain. Bisceglie describes how Interos continuously builds “family trees” of companies and scans for risk factors so customers can gain visibility into their supply chains and understand the vulnerabilities that can interrupt operations. She shares her proudest moments at Interos so far, the biggest challenge that female entrepreneurs face, and provides advice to women who are looking to start a business.

Listen to the podcast here

Interview with venture capital investor Nick Beim on where the AI revolution is headed, what makes an AI startup compelling to investors, what aspect of AI is most underdiscussed and whether the U.S. in danger of losing its technological lead in AI. Other topics covered include the misconception of AI as a superhuman kind of intelligence, where AI is a partner vs. competitor to human intelligence and the significance of basic research in the AI revolution.

Listen to the podcast here

Theoretically, new A.I. start-ups could compete with the giants over privacy and respect for user autonomy. But investors aren’t holding their breath. “If software is meritocratic, A.I. is feudal,” said Nick Beim, a partner at the venture-capital firm Venrock, which invests in A.I. start-ups. He has found that A.I. is an uphill battle for new entrants into the field, and not just because the technology is complicated. “Its power depends on how much data you have,” he said. “And when it comes to data ownership, the large internet platforms are in a dramatically different league than everyone else.”

Read the article in the New York Times

“If the nerds don’t show up and work on the mission of national defense…then I’m not sure who will,” says Chris Lynch, cofounder and CEO of Rebellion Defense. Lynch arrived at the Pentagon as an exotic outsider — the department’s resident hoodie-wearer, as Ash Carter put it. Now he and two co-founders have a defense-software startup with its own exotic aims.

Read the article in DefenseOne

Dataminr ingests public internet data, like social media posts, and uses deep learning, natural language processing, and advanced statistical modeling to send users tailored alerts. The company has more than 500 clients paying its subscription fees, including Amazon, CNN, and The United Nations, which uses the system to find early signs of potential humanitarian crises around the world.

Read the article in Forbes

For the first time in 70 years, American leadership in science and technology, which has underpinned our economic growth and national security since the end of World War II, is facing a serious challenge. The challenge comes primarily from China, at once a strategic competitor and one of our most important economic partners. Now is the moment for us to rise above our polarized political dysfunction and commit to an effective response.

Read the article in Business Insider

The United States needs a national security innovation strategy to avoid falling behind competitors in scientific and technological innovation across a range of emerging and foundational fields. This Task Force report by the Council on Foreign Relations offers policy recommendations for the federal government, industry, and academia. Progress on this issue will require contributions and creativity from all three sectors if the United States is to maintain its innovation leadership in these fields.

Read the Council on Foreign Relations Task Force Report

Jason Wenk seldom gives interviews, but he was eager to tell RIA Intel all about Altruist, his new, entirely digital custodian for RIAs that promises to be free of commissions and the headaches that come with cobbling together software services needed to run a wealth management business. Altruist will save advisors up to 90% on technology and custody costs, says Wenk. “Our goal is for everyone to really pay almost nothing.”

Read the article in Institutional Investor

Industry insiders will tell you that New York has always been a hub for technological innovation and enterprise, but a string of recent events – a planned Amazon office complex in Queens, Google’s $1 billion expansion in Manhattan, new regulations on the ride-hailing industry – have turned heads from the West Coast to the East Coast, making this the perfect time to release our first Tech Power 50 list.

Read the article in City & StateWebsites that allow folk to crowdfund legal cases are a new phenomenon. They allow scores of people without a direct interest in a case to cover a proportion of its costs. CrowdJustice, the only big player in Britain, set up shop in 2015 and is growing quickly. Though the website is used to fund only a small proportion of court applications, it is increasingly being used in high-profile cases… If crowdfunding helps some of them to get to court, it will expand, rather than shrink, the scope of justice.

Read the article in the Economist

“I don’t think the attitude of employees of Google is representative of Silicon Valley,” said Nick Beim, a partner at Venrock who invests in artificial-intelligence startups. “I think there are a lot of startups that see [work for the U.S. military] as an important form of public service, as well as a business, and are motivated by the broader mission of saving lives.” As companies like Google step back in some ways, others will step up, Mr. Beim added.

Read the article in the Wall Street Journal

Dataminr, a New York City-based startup that analyzes public data about events in real time, has closed a $392 million funding round at a $1.6 billion valuation, more than twice its 2015 valuation of $680 million. Tools like Dataminr are increasingly in demand as an inundation of data and information makes it harder to cut through the noise. Dataminr’s customers include companies in finance, media and government.

Read the article in Axios

Former Linklaters associate turned access-to-justice pioneer Julia Salasky was crowned Outstanding Innovator of the Year at the Legal Week Innovation Awards 2018 last month, for her work founding legal crowdfunding site CrowdJustice. Since launching the site in 2015, thousands of people have donated millions of pounds to fund hundred of cases around the world.

Read the article in Legal Week

Percipient.ai, a world class provider of advanced analytics for national security and now corporate security missions, announced today the first closing of its $14.7M Series A funding round, led by Venrock at a $58.5M valuation. Percipient.ai’s Mirage platform provides machine learning and computer vision for mission-critical security needs to accelerate and elevate the analysis of unstructured data at speed and scale. “Venrock has a distinguished record of investment and leadership in emerging technologies and innovation, from being an early investor in Intel and later Apple, to their investment in Percipient.ai’s innovation-leading AI platform today,” shared Balan Ayyar, Percipient.ai’s Founder and CEO.

Read the announcement

Venrock partner Nick Beim talks about the role of data in startup investments, the New York tech environment and what he looks for in new entrepreneurs. Venrock is a venture capital firm whose roots in technology go back to the 1970s, when it was an early backer of Apple. In the decades since, it has invested in hosts of companies that have disrupted industries and become household names. Venrock partner Nick Beim focuses on consumer, software, data-intelligence and fintech investments. We sat down with him to discuss new advancements in machine learning, the ways that startups can still overcome more established competitors, and why the best investment opportunities are rarely found where most people expect them.

Read the NYSE article

There’s a new economic force at work in the machine learning revolution that is capable of generating increasing returns to scale, much as network effects did in the internet revolution. This force is automated learning, and its business impact comes in the form of learning effects: the more a product learns, the more valuable it becomes.

Read the article in Techcrunch

CrowdJustice, a startup that brings crowdfunding to “public interest” litigation, has raised $2 million in seed funding for U.S. expansion. Founded in London in 2015 by ex-United Nations lawyer Julia Salasky, the idea behind CrowdJustice is to bring the Kickstarter model to legal cases that would otherwise find it hard to get funded. More broadly, the aim is to widen access to justice and use the law for social change — something that Salasky says is needed in the U.S. at the current time more than ever.

Read the article in Techcrunch

CB Insights today selected Dataminr to the prestigious Artificial Intelligence 100 list (“AI 100”), a select group of emerging private companies working on ground breaking artificial intelligence technology. CB Insights CEO and co-founder, Anand Sanwal, revealed the winners during The Innovation Summit, a gathering of top executives and investors to explore the industries of the future.

Read the article in CB Insights

Kevin Ryan, co-founder of MongoDB, Business Insider, and Gilt Groupe (among others), speaks with Nick Beim at Venrock about building teams and what to look for in a VC. Ryan advocates taking risks as an entrepreneur, even if it leads to a failure or two. You can learn a lot from unsuccessful ventures and it prepares you for the next thing.

Listen to the podcast

Founded by Mike Myer, a former senior employee at RightNow (which was acquired by Oracle and has become their customer service technology), Centricient is looking at providing these messaging management services to some of the largest companies.

Read the article in Techcrunch

Machine learning will likely have a barbell effect on the technology landscape. On one hand, it will democratize basic intelligence through the commoditization and diffusion of services such as image recognition and translation into software broadly. On the other, it will concentrate higher-order intelligence in the hands of a relatively small number of incumbents that control the lion’s share of their industry’s data.

Read the article in Techcrunch

Great discussion with Economist editor Patrick Foulis, Pat Grady and Amy Nauiokas on where the major disruptions will likely come in fintech, who the biggest winners and losers will be, where we are placing our biggest bets, what geographies are most advantaged and what our most controversial predictions are.

View the panel discussion in the Economist

Panel discussion at the DLD Conference on the rise and potential of impact investing with Matthew Bishop, Global Editor for the Economist, and Neil Blumenthal, cofounder and co-CEO of Warby Parker.

View the panel discussion at DLD

Interview with Harry Stebbings on The 20 Minute VC on the essence of venture capital, how to find exceptional people, the growth of real-time information discovery pioneer Dataminr, the emergence of New York as a startup hub, the advent of impact investing and gender bias in venture capital.

Listen to the 20 Minute VC podcast

There is an uncomfortable truth in the venture capital industry that runs awkwardly against its meritocratic aspirations: it is harder for women to raise money than it is for men. Since 2005, only 9.7 per cent of venture-backed founding teams in the US have included a woman, and far fewer were led by one. Other data suggests a similar conclusion.

What’s the reason for this? Rarely, but sometimes, I’ve seen it come from an unabashed bias about women’s ability to be as productive as men. Generally this relates to concerns that having or raising children will be a distraction. I believe this kind of bias is in substantial decline, however, as younger generations of investors rise to prominence.

Read the article in Wired

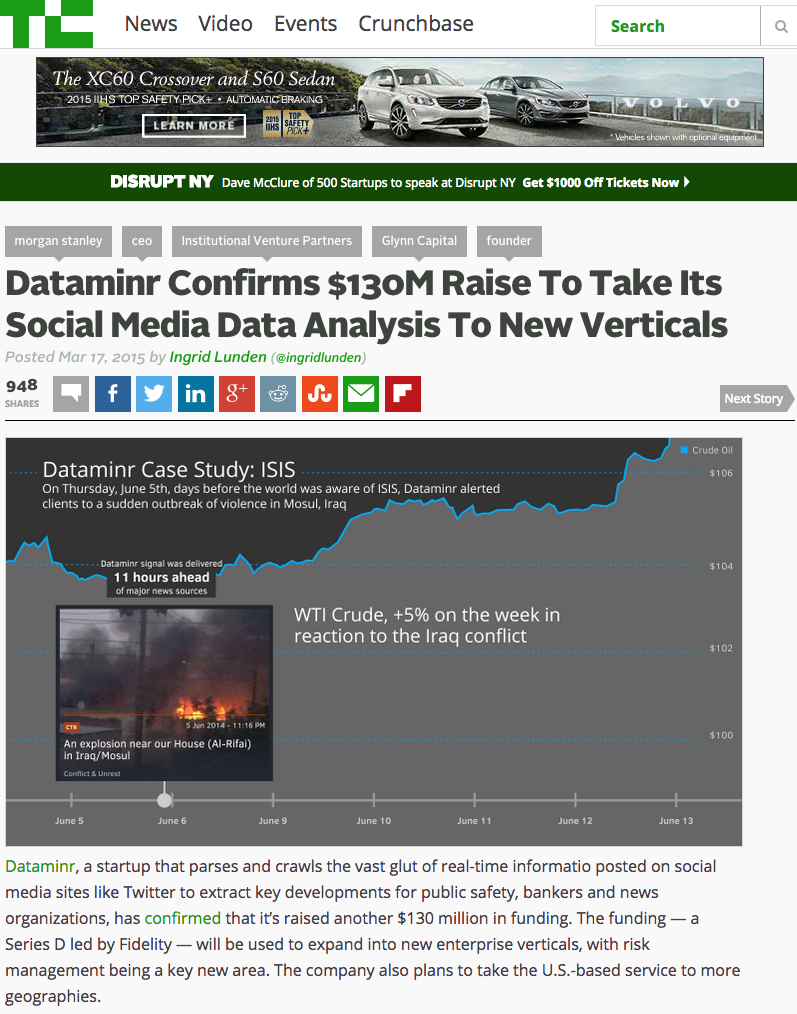

Dataminr, a startup that parses and crawls the vast glut of real-time information posted on social media sites like Twitter to extract key developments for public safety, bankers and news organizations, has confirmed that it’s raised another $130 million in funding. The funding — a Series D led by Fidelity — will be used to expand into new enterprise verticals, with risk management being a key new area. The company also plans to take the U.S.-based service to more geographies.

“This capital will enable our company to meet the tremendous global demand for our products, expand into a number of new markets, and integrate valuable new datasets into our algorithmic engine to enhance our Twitter-based signals and broaden our offerings,” Bailey, CEO and co-founder of Dataminr said in a statement.

Read the article in Techcrunch

Dataminr, which analyzes tweets and other information streams to create alerts for traders, reporters and government agencies, has raised $130 million from banks and institutions in a new private round. The deal values New York-based Dataminr at about $700 million, people familiar with the terms said. All told, the six-year old company has raised $180 million in equity from investors.

Dataminr’s new investors include mutual-fund firms Fidelity Investments, which led the round, and Wellington Management Co., along with Credit Suisse Group AG’s CS Next Fund, Goldman Sachs Group Inc. and Glynn Capital Management, the company said. Venture-capital investors Venrock and Institutional Venture Partners also added to their stakes in the company.

Read the article in the Wall Street Journal

Jason Richelson and his partner, Amy Bennett, lost thousands of dollars in sales after the server-based cash-register system crashed at Green Grape, their Fort Greene, Brooklyn-based business, in 2008. That disaster at the wine shop and gourmet food stores soon inspired Mr. Richelson to launch ShopKeep, a cloud-based point-of-sale system for high-volume retailers.

Fast-forward to today. The 180-employee firm has raised $37.2 million in venture capital from investors including Tom Glocer, a former CEO of Thomson Reuters. To max out the company’s valuation, it brought in Norm Merritt, former chief executive of iQor, a $550 million business-process outsourcing firm, as CEO and president eight months ago.

Read the article in the Wall Street Journal

Young companies thinking they might be worth billions may need a reality check. Despite the hubbub over select startups such as WhatsApp, the mobile-messaging app bought by Facebook for $19 billion, first-round valuations for U.S. startups fell last year, data show, even as later-round valuations surpassed levels of the dot-com era.

Seed-round funding valuations—set as a business prepares to launch, or soon after—dropped nearly 30% in 2013 to nearly $2 million, from $2.7 million in 2012, and less than half of a $4.8 million high set in 2000, according to Dow Jones VentureSource. Likewise, first-round funding valuations fell to $5 million, down 28% from $7 million in 2012 and off 58% from 2000’s $12 million.

Read the article in the Wall Street Journal

In 2011, Nick Beim made Forbes Elite 8: Who to Watch for in Venture Capital. Beim became a venture capitalist in 2004 and by 2006, JBoss, a company he invested in, was sold to RedHat for $350 million. Beim led the initial venture investment in such companies as the Gilt Groupe, The Ladders, Intent Media, Conductor, JBoss, and OatSystems.

Beim’s investments focus on internet, adtech, SaaS, mobile, big data, financial technology, and services investments. He also serves as a Board Member with Endeavor, a nonprofit that supports entrepreneurs in developing countries such as Argentina, Brazil, Colombia, Mexico, and Uruguay, and is a Member of the Council on Foreign Relations, where he co-founded a study group focused on technology and economics.

Read the article in AlleyWatch

Like many who have been active in the New York startup ecosystem over the past decade, I am optimistic about its future. The last 10 years have seen an increasing number of startup successes in New York. Shutterstock, Tumblr, AppNexus, Gilt Groupe, MongoDB, Etsy, Buddy Media, Warby Parker, Kickstarter, Gerson Lehrman, and OnDeck Capital are among them, and there are many others on the rise. Venture and angel funding are increasing, large Internet companies including Google and Facebook are growing their New York offices, and Cornell and Technion are collaborating to build a large engineering campus on Roosevelt Island.

Read the article

CNN is hosting a press event today to announce a partnership with Twitter and social analytics company Dataminr, resulting in a new tool called Dataminr For News.

Dataminr CEO Ted Bailey said the goal is to “alert journalists to information that’s emerging on Twitter in real time.” Basically, the technology looks at tweets and finds patterns that can reveal breaking news when it’s still in its “infancy.” Those alerts can be delivered in a variety of ways, including via desktop applications, email, mobile alerts, and pop-up alerts.

Read the article

Venrock Partner Nick Beim discusses the company’s big data investment plans with Deirdre Bolton on Bloomberg Television’s “Money Moves.”

Watch the video\

Dataminr Inc., the New York City startup that mines Twitter for tradable news, has raised an additional $30 million in private funding from venture capital firms.

The fundraising round, Dataminr’s third since its founding in 2009, is being led by Venrock and Institutional Venture Partners. It brings the company’s total fundraising to $46.5 million. In addition, Venrock partner Nick Beim will join Dataminr’s board of directors.

Read the article

Alexandra Wilkis Wilson walked into famed celebrity designer Zac Posen’s showroom in November 2007 prepared to give the pitch of her life. The Gilt co-founder was attempting to sell Posen and his team on putting some of the designer’s excess inventory on the yet-to-be-launched flash sales e-commerce platform. At the time, the flash sales industry was nascent, so many, including the fashion industry, had no idea what a flash sale was.

Wilson and her CTO at the time, Mike Bryzek, stepped into the meeting armed with a demo, a bunch of mockups, and information (all of which were online). However, they quickly realized that Posen’s office didn’t have Wi-Fi. So Wilson, thinking on her feet, just took a pen and paper and started sketching the idea out. Posen’s team liked what they saw and became the first designer to sell their items in Gilt in late 2007.

Read the article

A couple of years ago, LinkedIn co-founder Reid Hoffman and Nick Beim sat down and started brainstorming with Linda Rottenberg, co-founder and CEO of the Manhattan-based nonprofit Endeavor. The nonprofit, where the two men are board members, provides mentorship, networking opportunities and strategic advice to entrepreneurs. What if it could design a new kind of financing vehicle that would work, in some respects, like a for-profit investment fund?

Read the article

Most people couldn’t pull off the feat of leaving a stable career to pursue a passion and develop it into a $1 billion company. But that’s the experience of Alexis Maybank, the founder and chief strategy officer of Gilt Groupe Inc., the members-only online shopping website.

Read the article

The Social Innovation Summit is a private, invitation-only forum that explores “What’s Next?” in the world of Social Innovation. Tailored to executive leaders interested in discussing the strategies and business innovations effecting social transformation across the corporate, investment, government, and non-profit sectors. Participants will include hundreds of top Fortune 500 Corporate Executives, Venture Capitalists, Government Leaders, Emerging Market Investors, Foundation Heads and Social Entrepreneurs eager to discuss social challenges, analyze innovative approaches and build lasting partnerships that enable them and their organizations to affect positive social change.

Read the article from UNMultimedia.com

Nick Beim discusses the venture capital environment in New York and outlook for Internet startups. Beim speaks with Deirdre Bolton on Bloomberg Television’s “Money Moves.”

Watch the video

She’s worked with Rupert Murdoch, Martha Stewart, Jane Fonda, and Michael Eisner. She helped put Patty Hearst in jail and Desperate Housewives on the air. Now she’s at Gilt Groupe, the hot luxury website, and she’s making herself over once again.

Read the article

Nick Beim discusses LinkedIn Corp.’s initial public offering and stock valuation. Beim speaks with Deirdre Bolton on Bloomberg Television’s “InsideTrack.”

Watch the video on Bloomberg TV

Gilt Groupe Inc. hasn’t made a penny in profit since it was founded in 2007 as an online discounter of hot designer goods like Reem Acra gowns and Rebecca Minkoff handbags.

Read the article

Seeing names like Accel Partners’ Jim Breyer and Sequoia Capital’s Mike Moritz atop the Forbes Midas List might be about as expected as seeing UConn and Kentucky in the Final Four. There are perennial powerhouses in venture capital whose names should – for good reason – find themselves at the top of the heap.

But just as the NCAA expanded its tournament field this year to include four up-and-coming at-large teams, we found ourselves looking beyond the usual suspects at those who didn’t make the cut this year, but are doing the right things today to get themselves on the Midas List in years to come.

Read the article

Nick Beim discusses Facebook Inc.’s valuation after Goldman Sachs Group Inc. and Digital Sky Technologies were said to have bought a $500 million stake in the social-media company. Beim speaks with Deirdre Bolton on Bloomberg Television’s “InsideTrack.”

Watch the video on Bloomberg TV

“I CAN’T decide what I like poking more: you, or these bubbles,” says bubble-blowing Kim Kardashian, a reality-TV star, in a new application for Facebook (see right). Cameo Stars, the company responsible for this innovation, lets Facebookers send to their online friends clips of minor celebrities mouthing generic greetings. Besides enriching the world’s culture, the firm may also make a fortune. But gloomy types wonder if the profusion of highly valued internet start-ups with lighter-than-air business plans is evidence of a different kind of bubble.

Read the article

Nick Beim talks about investment strategy and the role of venture capital in start-up technology firms. Beim speaks with Deirdre Bolton on Bloomberg Television’s “InsideTrack.”

Watch the video

Imran Amed speaks to Alexis Maybank and Alexandra Wilkis Wilson, co-founders of Gilt Groupe, the start-up that is taking that fashion industry by storm.

Read the article

2007 marks Endeavor’s 10th year anniversary of supporting High-Impact Entrepreneurs in emerging markets! These entrepreneurs have the potential to generate millions in revenue, create thousands of jobs, and inspire countless others. Endeavor – “the best anti-poverty program of all.” Thomas Friedman

Since Susan Lyne made a big name for herself at the top of ABC Entertainment and then Martha Stewart Living Omnimedia (MSO), her move to the CEO position at tiny Gilt Groupe seems to be a head scratcher. Have you heard of this year-old startup? I hadn’t. My younger, fashionable colleagues say it’s a big thing: an online marketplace of excess luxury goods that is already shaking up the fashion world.

Read the article